INDIA’S 1st CHOICE DEBT SOLUTION COMPANY

If your answer is yes to all the above question

Then

We will give you a strategy where you can legally defend yourself from creditors and recovery agents. Along with that, Our advisors will guide you how to pay your EMIs within your Income no matter what your EMIs is.

- Note: You can clear your loan without taking any Loan.

Be financially free with Us we will help you to pay your EMIs and free from recovery agents and creditors.

Get started if you want to take control of your finances and get rid of the creditors and recovery agents.

What you will get if you enroll with SingleDebt.

We will provide you a proven strategy to become debt-free within the existing Income and you will also get the legal support from our experts

- You will never have to face creditor’s harassment – It’s our responsibility.

- You will never miss your EMIs anymore.

- You don’t have to stress anymore for the legal matters. We will reply on behalf of you.

**** Be quick, or else creditors will chase you anytime and harass you at any place ****

Free Enrollment. We Are Giving Debt Advice For FREE Worth Rs. 3,000/-

Please Check All Boxes Where Your Answer Is YES!

If you’ve checked ANY of the boxes above, then my friend you’re invited & highly welcomed to join the debt free workshop

- Want to take control of your finances

- Register before July 31st, 2023, to unlock bonuses worth ₹ 4,500

WHAT IF WE TOLD YOU...

You will never miss your EMIs, never ever face creditor’s, also, you can save a lot of money within the Income

“Secret Financial Strategy”

Yes… You Heard It Right!

Here is the mistake that most people usually make: Overlook debt management, Neglect emergency savings, and taking lightly the creditor’s notice.

If You Want To Fix It And Want To Become Financially Free, Then I’ve Got Super Good News For You!!!

We will gonna share our 100% proven strategies, hacks, and Tactics that helped 25,000+ individuals to be free from all the debts and loans.

News & Media

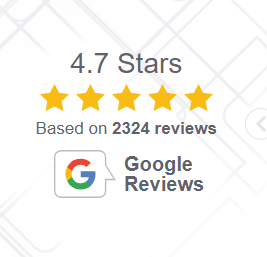

WHAT OUR HAPPY CLIENTS SAY ABOUT US

FAQs

If you have defaulted on a payment then your credit score would have been affected already. With our debt management plan, as your creditors receive regular payments, this will start reflecting on your credit report which in turn will help improve your score over time. It is important that you keep up with the repayments on the plan as your creditors will be keeping a close eye on regularity of your payments.

Your credit report may reflect that you are on a repayment plan, although some creditors may not register it. With regular payments, your credit score will improve. It is important that the plan is followed through on time, every month.

Each plan is tailored to your requirements. We make sure you have enough income to cover your essential bills, like rent, food, utility bills, medical and travel expenses. The remaining money (disposable income) will be set aside to pay back your creditors every month.

We would love to speak with you and understand your financial circumstance. Please contact us or fill the online registeration form and one of our debt advisors will be in touch. Tel: +91 (961) 910-3594