How, we can help

We offer a wide range of debt solutions and services to suit every situation. You can read more about our services:

- 1. Debt- free Solution

- 2. Stop-Harassment from the recovery agents.

- 3. Settlements

- 4. Legal Services

Debt Management Plan to become Debt-Free

One of the most popular solutions that SingleDebt has to offer is a payment plan that allows you to pay off all of your unsecured debts at one affordable rate. This is known as a Debt Management Plan (DMP) which SingleDebt will set up and manage for you with all of your creditors.

This plan allows us to systematically pay off each one of your creditors at a rate you can afford and get you on the road to becoming debt-free. Our Debt Management Plan can only be used for unsecured debts, these are debts that have not been secured against any property or asset. Typical examples of unsecured debts are personal loans, credit cards, education loans and bank overdrafts.

Once SingleDebt has set up all relevant payments with your creditors, your regular monthly payment to us will be distributed to your creditors. Our aim will be to reduce as many of your accounts as possible within the shortest time possible, getting you debt free and stress free in a timely manner.

Key features

You’ll only pay what you can afford each month.

We’ll reduce your monthly repayments to an affordable level.

You’ll only repay your debt to multiple creditors with a single, comfortable monthly payment.

Whatever your situation is, we can help you.

In some cases interest will be frozen

We will deal with your lenders on your behalf and start paying off one creditor at a time, so that you become debt-free.

You won’t have to deal with creditors, we do that for you.

We handle all sort of communication such as legalizing the documents and verbal communication with your creditors on your behalf.

We can help you become debt-free so that you can get your life back on track.

The term for your Debt Management Plan will depend on your debt level and what you can afford to pay towards the debt plan. You will be assigned a SingleDebt Advocate and account manager that will manage your plan for you and will support you every step of the way.

RBI Advice

RBI Advises that Debt Management is Right for People in Debt.

RBI advises people who are struggling with debt to seek professional help from Credit Counselling Centers. SingleDebt specialises in these services, which is free debt counselling, financial education, and debt solutions. RBI defines a Debt Management Plan (DMP) as – “negotiating with the creditors to establish a reduced payment plan (EMIs) and request a reduction in the interest charged. This is the process of restructuring debts so that borrowers gradually overcome their debt burden and improve their money management skills”

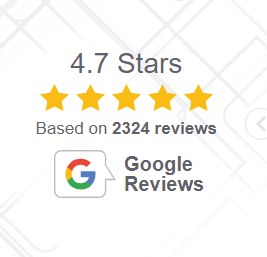

TRUSTED BY INDIA

HELPED MORE THAN 25,000+ DEBT-RIDDEN INDIVIDUALS IN INDIA.

OVER 35 YEARS OF DEBT MANAGEMENT SOLUTIONS EXPERIENCE.

INDIA’S NO.1 DEBT MANAGEMENT & LEGAL SERVICES PROVIDER.

WHAT OUR HAPPY CLIENTS SAY ABOUT US

FAQs

If you have defaulted on a payment then your credit score would have been affected already. With our debt management plan, as your creditors receive regular payments, this will start reflecting on your credit report which in turn will help improve your score over time. It is important that you keep up with the repayments on the plan as your creditors will be keeping a close eye on regularity of your payments.

Your credit report may reflect that you are on a repayment plan, although some creditors may not register it. With regular payments, your credit score will improve. It is important that the plan is followed through on time, every month.

For your repayment plan to have optimum affect, all unsecured debts should be included on the plan. This allows you to free up as much disposable income as possible to pay off your creditors. Our aim is to get you out of debt as quickly as possible.

Each plan is tailored to your requirements. We make sure you have enough income to cover your essential bills, like rent, food, utility bills, medical and travel expenses. The remaining money (disposable income) will be set aside to pay back your creditors every month.

We would love to speak with you and understand your financial circumstance. Please contact us or fill the online registeration form and one of our debt advisors will be in touch. Tel: +91 (961) 910-3594