About Course

Description

This course helps you unlock the potential of credit funding with our comprehensive course designed to empower you in securing the capital you need for your business or personal endeavors. This course provides an in-depth understanding of credit funding, covering essential topics such as:

Types of Credit Products: Explore various credit options available, including secured and unsecured loans, lines of credit, and invoice financing.

Legal and Regulatory Framework: Gain insights into the legal landscape governing credit funding to navigate it confidently.

Application Process: Learn how to assess risk, structure loan terms, and identify suitable lenders for your needs.

Evaluating Funding Sources: Develop a strategic plan to secure the most advantageous credit products tailored to your circumstances.

Through engaging lectures, practical activities, and real-world case studies, you will acquire the skills necessary to effectively use credit as a tool for building a successful business.

Additionally, you will explore the mental health benefits of managing debt wisely and how our online platform facilitates easy access to resources and support.

1. Introduction to Financial Wellbeing

Understand what financial literacy is and why it’s vital for everyone. We’ll set the stage for the course and your journey to taking control of your finances.

2. Essential Banking Services

Discover the fundamental services banks offer, from different account types to debit cards. Learn how these services simplify managing your money day-to-day.

3. Opening and Managing Bank Accounts

A step-by-step guide to opening a bank account. We’ll cover what to consider when choosing a bank, required documents, and how to manage your account effectively for smooth transactions.

4. Understanding Banking Lingo

Demystifying common banking terms! This chapter breaks down essential jargon, making it easier for you to understand your bank statements and communicate confidently about your finances.

5. Fundamentals of Credit

Explore the basics of credit – what it is and how it works. We’ll touch upon credit agreements and credit cards, building a foundational understanding of this financial tool.

6. Credit Scoring and Credit Reports

Learn about credit reference agencies and the importance of your credit score. We’ll guide you on how to obtain and understand your credit report and how your score impacts loan approvals.

7. Pros and Cons of Using Credit

A balanced look at the advantages and disadvantages of using credit. Equip yourself with the knowledge to leverage credit wisely while being aware of potential risks and how to avoid them.

8. Debt Prevention Strategies

Practical techniques to avoid falling into debt. Learn how to budget effectively, analyze your spending habits, and make informed financial choices to maintain a healthy financial life.

9. Steps to Eliminate Debt

A clear action plan for tackling debt. We’ll outline strategies to help you understand your debts, prioritize repayments, and work towards achieving financial freedom from debt.

10. Personal Loans: An Overview

An introduction to personal loans. We’ll explore what they are, their potential uses, and key considerations before taking out a personal loan to ensure it aligns with your financial goals.

Course Content

Complete Guide to Personal Finance: Banking, Managing Credit, Loans & Debt Solutions for Indians

-

1. Introduction to Financial Wellbeing

01:45 -

2. Essential Banking Services

02:22 -

3. Opening and Managing Bank Accounts

05:59 -

4. Understanding Banking Lingo

08:33 -

5. Fundamentals of Credit

03:17 -

6. Credit Scoring and Credit Reports

02:26 -

7. Pros and Cons of Using Credit

02:33 -

8. Debt Prevention Strategies

01:03 -

9. Steps to Eliminate Debt

07:39 -

10. Personal Loans: An Overview

04:09

Financial literacy quiz?

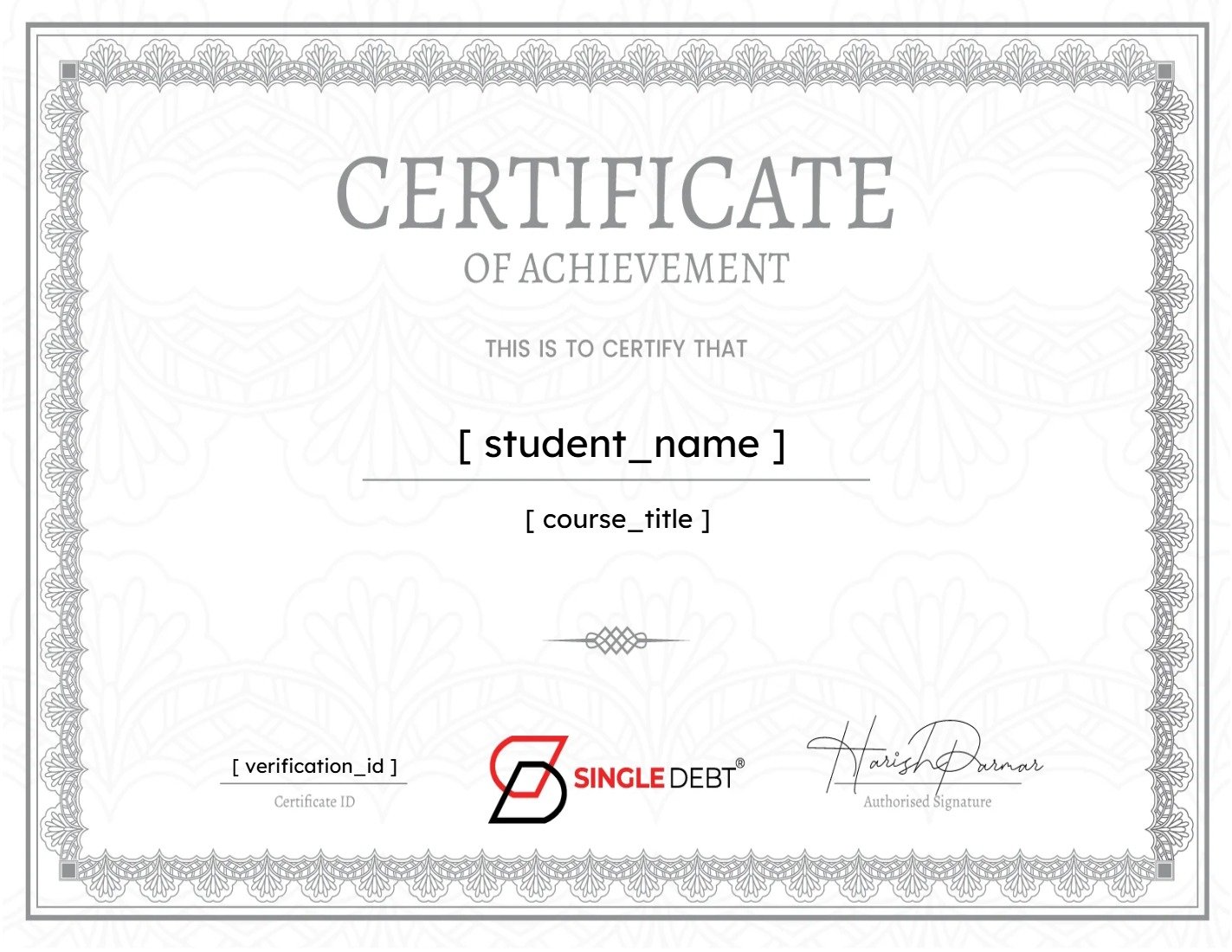

Earn a certificate

Add this certificate to your resume to demonstrate your skills & increase your chances of getting noticed.