India's Debt Dilemma: Credit fueled dreams crushed by debt crisis.

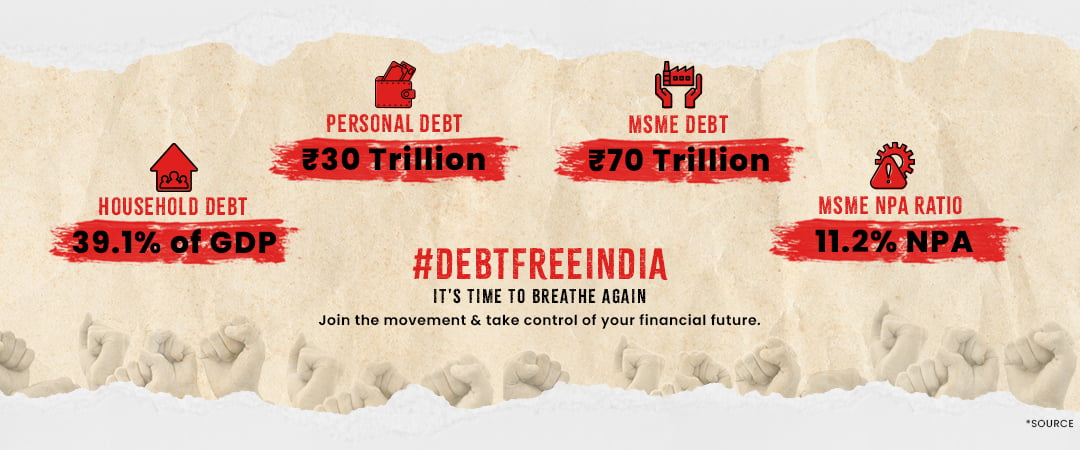

India's economic growth relies heavily on access to credit, empowering individuals and MSMEs to improve their quality of life and contribute significantly to the GDP and exports. However, this reliance on debt poses risks, with household debt reaching 39% of GDP and rising non-performing assets (NPAs) in both personal and MSME loans. Effective debt management is crucial to prevent a cycle of overspending and financial instability, underscoring the importance of responsible borrowing and financial education.

What is Debt Trap?

A debt trap is a situation where an individual or entity finds themselves unable to repay their existing debts. This often leads to taking on more debt to cover the previous ones, creating a vicious cycle that's difficult to escape.

Key characteristics of a debt trap

Accumulating debt

A constant increase in debt over time.

Difficulty in repayment

Income is insufficient to cover debt obligations.

High-interest rates

Exorbitant interest charges exacerbate the problem.

Limited options

Few viable solutions to break free from the cycle.

Devastating Impact of Debt

Debt is a burden that extends far beyond the financial realm, profoundly impacting the mental, physical, and social well-being of individuals and families. The search results paint a grim picture of the multifaceted challenges faced by those struggling with debt.

The Devastating Impact of Debt

Creditor Harassment and Mental Health

Long-Term Effects on Family Relationships.

Impact on Children's Well-Being.

Managing Debt-Related Stress.

Physical Health and Daily Functioning.

Good Debt vs Bad Debt: Understanding the Difference

The concept of “good debt” and “bad debt” is crucial for individuals to grasp when managing their finances. Knowing the distinction between the two can help you make informed decisions and achieve your financial goals.

Good Debt

Debt that is used to finance assets that appreciate in value or generate income over time.

Examples:

– Mortgage loans for a primary residence

– Student loans for higher education

– Business loans for investments in equipment or expansion

Good debt can help you build wealth and achieve your long-term financial goals. It is considered an investment in your future.

Bad Debt

Bad debt is debt that is unlikely to be repaid by the borrower due to high-interest rates, bad management, or unforeseen circumstances.

Examples:

– Credit card debt for non-essential purchases

– Personal loans for vacations or other discretionary spending

– Payday loans with high-interest rates

Bad debt can lead to a vicious cycle of debt, high-interest payments, and financial stress.

What the Movement Aims to Achieve

The Debt Free India movement is working towards the following goals:

● Building a supportive community of individuals and businesses committed to achieving financial freedom

● Educating the public about debt management strategies and financial literacy

● Providing access to affordable and effective debt management solutions

● Advocating for policies and regulations that protect the rights of debtors

By joining the #DebtFreeIndia movement and working towards a debt-free future, individuals and MSMEs can enjoy the following benefits:

Financial Security: With the burden of debt lifted, you can focus on building wealth and securing your financial future.

Peace of Mind: Living debt-free means less stress, anxiety, and worry about making ends meet. You can enjoy a better quality of life and focus on what truly matters.

Improved Relationships: Debt can strain personal relationships, but a debt-free life allows you to nurture stronger connections with family, friends, and loved ones.

Opportunities for Growth: Without the constraints of debt, individuals and businesses can invest in their personal and professional development, unlocking new possibilities for success.

How SingleDebt Can Help You

Our team of financial advisors will carefully assess your financial circumstances to create a personalized debt resolution plan that works for you.

- Personalized Debt Management Plans: We’ll develop a customized strategy to tackle your debts efficiently, considering your income, expenses, and financial goals.

- Expert Financial Guidance: Our experienced advisors will provide clear, actionable advice on budgeting, debt consolidation, and financial planning.

- Comprehensive Legal Support: Our legal experts will protect your rights, negotiate with creditors, and explore potential legal options.

- End Creditor Harassment: We’ll act as a shield, stopping harassing calls and letters from creditors, giving you peace of mind.

- Proven Success Stories: Join countless Indians who have overcome debt with our support. Discover how we can help you achieve financial freedom.

Take Action Today

Join Our Debt Free India Community Forum

Connect with others on the same journey, share tips, and find support.

Sign the Petition

By signing this petition, you are supporting a movement to protect individuals from the devastating impact of debt crisis and financial hardship.

Debt Solution

Explore our products to learn more about your insurance options, and receive a quote within minutes.

Join Community Forum

Welcome to the #DebtFreeIndia Community Forum! You can join an on-going conversation or start a new topic of your own to share your experiences and questions with the community of other debt-trapped Indians, our financial advisors and advocates. We are here to help. Let’s make this vision a reality.

Check the trending topics on our #DEBTFREEINDIA forum

1. Debt Solution

1. What strategies do you recommend for managing debt and building an emergency fund?

2. What is irresponsible lending

3. Are Debt Management Plans (DMP) RBI approved?

2. Financial Education

1. How does debt-to-income ratio impact my financial health?

2. What is bankruptcy?

3. What is the difference between secured and unsecured loans?

3. Legal Know-How

1. What is Lien and how does lien work?

2. What consumer rights do you have when dealing with creditors harassment?

Empower Your Financial Future – Learn for Free!

Gain the skills and knowledge to take control of your finances. Enroll in our free financial education courses designed to help you grow, save, and succeed.

MEDIA FEATURE

Blogs

Frequently Asked Questions

The #DebtFreeIndia movement is a nationwide initiative led by SingleDebt, aimed at empowering individuals and small businesses to overcome the burden of debt and achieve financial freedom. Through this movement, we are working to raise awareness about debt management strategies, provide access to affordable debt solutions, and build a supportive community of those committed to becoming debt-free.

By joining the Debt Free India movement, you’ll gain access to a supportive community of individuals and businesses who are on the same journey. You’ll also benefit from SingleDebt’s expert guidance, which can help you achieve financial security, peace of mind, and the freedom to pursue your dreams without the constraints of debt.

The Debt Free India movement is designed to support both individuals and small businesses. We understand that debt can be a significant challenge for MSMEs, and we’re committed to providing tailored solutions to help them overcome their financial obstacles and achieve long-term sustainability.

Join the #DebtFreeIndia movement with SingleDebt, take a stand against the growing debt crisis affecting millions across the nation. Together, we can empower individuals and MSMEs to break free from the cycle of debt-trap. Let’s work together to create a debt-free future where everyone has the opportunity to lead a mentally peaceful, financially stable life and thrive!

Disclaimer: The statistics and information provided on this website are sourced from reputable publications, industry reports, and government data. However, as the data landscape is constantly evolving, we recommend verifying the most up-to-date figures with authoritative sources relevant institutions.