How to Raise Your CIBIL Dispute and Improve Your Score

A CIBIL dispute refers to the process of raising a formal complaint or disagreement with the Credit Information Bureau India Limited (CIBIL) regarding any inaccuracies or discrepancies found in an individual’s credit report. What Is CIBIL Dispute All About? A credit report is a comprehensive record of an individual’s credit history, including details of their […]

How to Remove Name from CIBIL Defaulters List?

Have you found yourself caught in the challenging position of being named on the CIBIL defaulters list? You should investigate what caused the default and take steps to rectify it as soon as possible. This could involve contacting the lender to arrange a payment plan or appealing to the credit bureau to remove the default […]

How do bad financial habits affect your future?

Bad financial habits can have a profound and lasting impact on your future financial well-being. From excessive spending and accumulating debt to neglecting savings and failing to plan for the future, these habits can hinder your ability to achieve your financial goals and create financial stability. In this blog post, we will delve into the […]

Does stop payment affect your credit

It’s crucial to understand how certain decisions can effect your credit score when handling your finances. Stop payments, as the name suggests, are a type of financial word that relates to telling your bank to cancel a previously authorised cheque or payment.This article’s goal is to explain the consequences of making a stop payment and, […]

What Is Financial Wellness, and Why Is It Important?

Download audio The basics of Financial wellness guide to the state of a person’s overall financial health. It goes beyond the concept of just having money and focuses on achieving a sense of financial stability, security, and peace of mind. It encompasses different values of personal finance that include saving, budgeting, debt management, investment, and […]

Why Is Financial Literacy Important For Children to Learn?

Apprehending financial topics is important for everyone, no matter what caste, creed, or age group you are. Whether it’s managing your home, or handling student loans, the use of this topic helps individuals to take control of financial crisis. Making a stern decision is also very important when it comes to money management. Financial literacy […]

Phishing Scams, What Does it Mean and How to Prevent it

Phishing Scams, What Does it Mean and How to Prevent it As a democratic country, India is now introducing the concept of the digital world. In past recent years, pandemics have majorly affected many people’s lifestyle as well as the mental health. People started taking loans to meet their needs and adapted to digital payment. But […]

How to remove a suit filed in CIBIL when a loan is closed

Being served with legal papers can be frightening and confusing. Choosing the court where the lawsuit will be heard must be one of your first priorities. You must take measures to get the litigation deleted from CIBIL’s records if it has been filed there. This blog post will cover how to defend your credit score […]

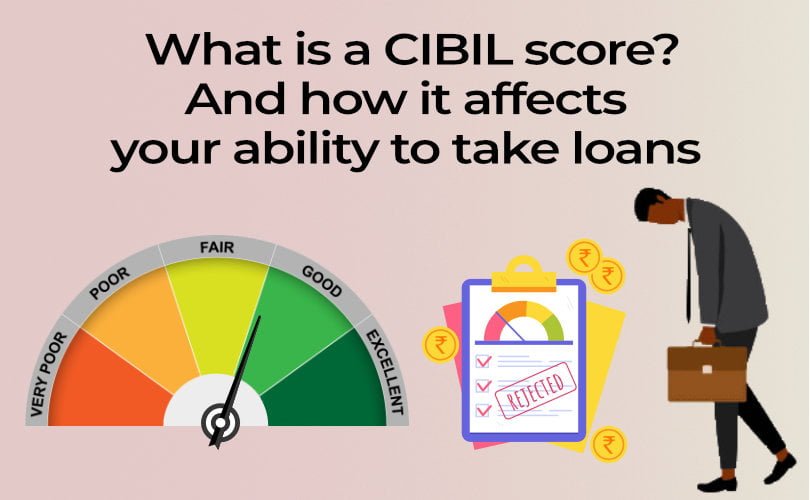

What is a CIBIL score? And how it affects your ability to take out loans

Consumers now rely on credit cards and loans to help them reach their aspirations and financial objectives. One of the most important criteria and measurements for obtaining this desperately required credit access is the CIBIL Score. What Is CIBIL? This is a question we all have in our heads when we run around for loans. […]

What can happen in personal loan default?

A personal loan is an unsecured loan which can be anything from an Individual borrowing money for personal needs to making investments in a company. Many people take out personal loans to cover unexpected expenses or to consolidate their debts. A personal loan can be a good option if you have a good credit score […]