Media

- 11th Oct 2025

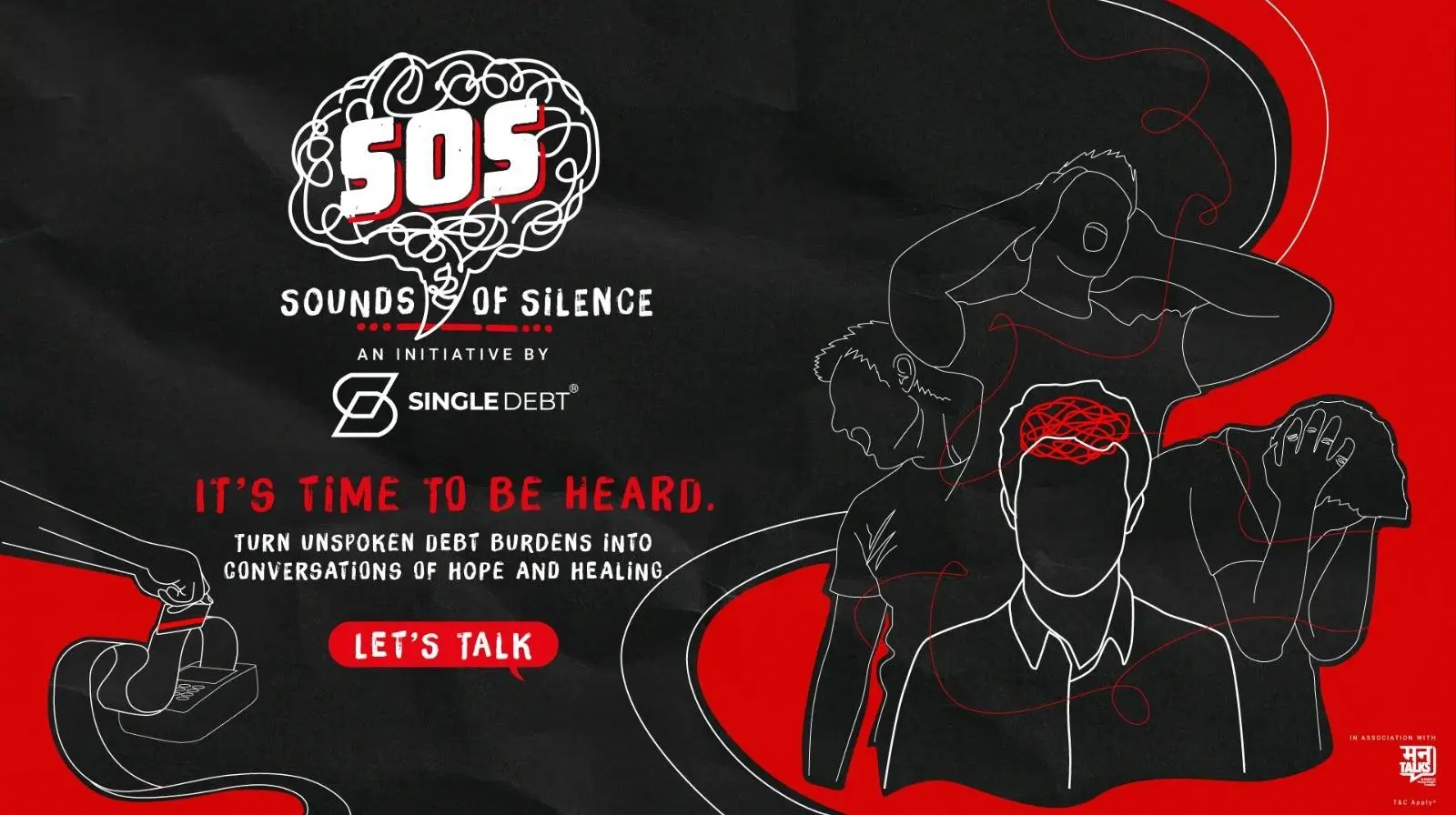

Mumbai: India’s growing conversation on mental well-being has a new protagonist—the monthly EMI—arriving on time, lingering past midnight, and eroding sleep, focus, and dignity for debt-burdened households, a trend the Economic Survey links to real productivity losses for the nation.

- 10th Oct 2025

आजकल कर्ज एक गंभीर मानसिक समस्या बन गया है. आसान लोन उपलब्धता के कारण लोग तनाव में हैं. नौकरी छूटने या नुकसान होने पर EMI का दबाव बढ़ जाता है, जिससे चिंता और डिप्रेशन होता है.

- 09th Oct 2025

- 07Oct, 2025

Mumbai (Maharashtra) [India], October 7: India’s growing conversation on mental well-being has a new protagonist–the monthly EMI–arriving on time, lingering past midnight, and eroding sleep, focus, and dignity for debt-burdened households, a trend the Economic Survey links to real productivity losses for the nation.

- 07th Oct 2025

- 07Oct, 2025

Mumbai (Maharashtra) [India], October 7: India’s growing conversation on mental well-being has a new protagonist–the monthly EMI–arriving on time, lingering past midnight, and eroding sleep, focus, and dignity for debt-burdened households, a trend the Economic Survey links to real productivity losses for the nation.

- 07th Oct 2025

- 07th Oct 2025

Mumbai (Maharashtra) [India], October 7: India’s growing conversation on mental well-being has a new protagonist–the monthly EMI–arriving on time, lingering past midnight, and eroding sleep, focus, and dignity for debt-burdened households, a trend the Economic Survey links to real productivity losses for the nation.

- 11th Nov 2024

- 11th Nov 2024

A rise in unsecured credit among a consumer group that symbolises

the country’s investment potential is hurting its economic ambitions

- 22 April, 2023

Many different aspects of your life might be ruined by the burden of debt. Your physical and mental health may both be impacted. Furthermore, it’s crucial to understand that continuing…..

- 15 October 2023

Bank of India report, 53 per cent of loans disbursed by NBFCs, and 10.8 per cent of the total amount disbursed, came through digital channels. In the case of banks, only 6.04 per cent of loans….

- 11 Jan, 2023

Most people are borrowing to finance their consumption needs. While banks and financial institutions increased their focus on retail lending in the last decade amid a softening interest-rate regime…..

- 30 December 2023

For both private individuals and commercial entities, debt may be a heavy burden. But owing to creative businesses in India, managing debt is now easier and more effective than ever. This article will look at five Indian firms that are redefining debt relief and giving consumers back control over their finances.

- 18 August 2023

The Reserve Bank of India (RBI) has issued comprehensive guidelines regarding penal charges in loan accounts in an effort to promote fairness, transparency, and accountability in the lending practices of financial institutions.

- 31 July 2023

Peer-to-peer lending or P2P loan is a form of online lending that directly connects borrowers and lenders, cutting out the intermediaries like banks or financial institutions. This alternative financing model relies on digital platforms that match borrowers seeking loans with individuals or institutions willing to lend their money. In this way, P2P lending enables a direct interaction between the two parties involved.