A debt management plan, or DMP in short, is an easy payment plan that helps you to maintain your debts. Those who are having difficulties in repaying their debts or unable to negotiate for a lower monthly payment can set up a debt management plan.

The debt management plan is an effective yet smooth procedure, so it’s perfect for those who have limited sources of income and are looking for a debt advisor to resolve their debts rather than taking a risk.

Generally, a debt management plan makes it easier for you to maintain your financial stability, stay stress-free, rebuild your credit record, and payback your debt at an affordable rate. A debt management plan can be obtained by contacting the best debt management company. The company can help you with the repayment of debts in an authorised manner and under the regulation of The Reserve Bank of India.

In case you have missed a monthly payment or are about to miss the next payment due to difficulty in earning income, getting help at the right time can help you resolve your problem.

Missing out even a single monthly payment can straight cause you problems like mental stress and harassment from recovery agents for the recovery of debts.

Your debt management plan is a versatile way to repay your debts and become debt free. Consulting a debt management service provider will initially ask you for all your financial details. These details include your income and expenses, as well as how much debt you have. Later, they will check for your eligibility, whether you’re eligible to repay your debts through a DMP.

When you are eligible to repay your debt, our debt advisor will give you a debt management plan. Our experts will at the same time make an agreement with creditors and banks to accept a lower payment than you used to make.

After the negotiation is agreed, you will be paying a fixed amount every month to your account manager, and they will repay to your creditors. As part of this procedure, at the beginning of the two months, they will owe their creditors and banks their service charges. They must begin repaying the banks and creditors at the end of the third month.

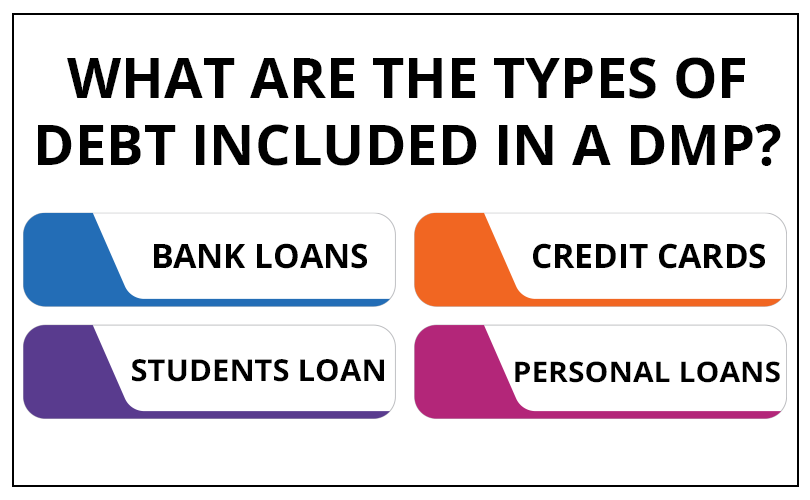

Debts which are included from an unsecured loan are considered for a debt management plan:

Debt management plans include the amount that is lower as compared to your original price negotiated with banks or creditors. The benefit of an affordable debt management plan will help you become debt-free affordably.

It is important to know that, missing your monthly instalment can be problematic and may significantly take more time to pay off your debts.

Your debt management plan is simplified and vary on how much debt you have, and how much you can afford to pay on a monthly basis. The plan may take a few years to resolve your problems and may even resolve debts at the earliest.

It is important to know that, if your DMP involves you making repayments than what you were actually paying can have an adverse effect on your credit score as well. This means that it will be more difficult for you to get a new loan.

A debt management plan will benefit your life for many reasons which are as follows:

· Reducing stress – By opting for a debt management plan you are securing your mental peace back, as there is so much relief in a lower and simpler way to repay your debts.

· Protecting you from creditors – making an agreement with creditors for a DMP reduces the chance of getting constant calls from debt recovery agents.

· Getting your finance back on track- A Debt Management plan will let you focus on your financial stability, while allowing you to repay your debts.

There are some downsides involved when you opt for a debt management plan, which you may find overweighed by the benefits

· Can affect your credit ratings- A debt management plan affects your credit score adversely. But, for the future, DMP is the smarter way to avoid serious problems with lenders.

· Increase in interest charges- when you’re typically on DMP, there is an increase in your interest charges annually for a longer period of time. However, lenders will sometimes agree to freeze your interest charges during your DMP.

· Some creditors may still contact you– If you’re struggling to repay your debts, you are still at the urge of getting harassment calls from your creditors

There is no obligation from the creditor to accept your Debt Management Plan. Your account manager will negotiate with your creditors to accept a payment which is reduced from the payment you use to pay. It is necessary to outline what you can afford to pay each month.

There is a possibility that your creditors will not accept your Debt Management plan due to the reduced repayment amount.

If you are struggling with repayment of debts, the last thing that will hit the course is to stop paying them. This can lead to recovery agent harassment and severely affect your credit score. If you feel you are not in a position to repay your EMI’s, a debt solution is always available. A debt solution program with us will give you an affordable Debt Management plan so you can repay your debts and live stress-free. Contact SingleDebt on +91 961 910 3594 or fill out the form either on the home page or contact page.

One Response

Excellent article! The tip on developing a retirement budget is so helpful. I’ve been using this strategy, and it’s helped me on track. I also created a no-cost resource on how to get started, which your readers might find useful. Great job!