How to File a Complaint with the Banking Ombudsman: A Step-by-Step Guide

Do you know that if your bank ignores your complaint, delays action, or harasses you, you can directly escalate your issue to the Reserve Bank of India (RBI) without paying a single rupee? Under RBI’s Integrated Ombudsman Scheme (RB-IOS), 2021, Indian consumers now have a simpler, unified process to seek justice against banks, NBFCs, and […]

How to Choose a Debt Management Plan in India

Do you know that India’s household debt is close to 43% of its total GDP? If you’re struggling to juggle multiple EMIs, facing relentless creditor harassment, or feeling overwhelmed by debt, a Debt Management Plan (DMP) might be the structured solution you need. But how do you choose the right debt management plan? With so […]

New Financial Year 2025: Why SingleDebt’s Debt Management Plan is a Smart Choice for Middle Class

As the calendar flips in April to Financial Year 2025, millions of Indians are grappling with a dual reality: the promise of new tax benefits and the looming pressure of rising costs. With toll prices climbing, UPI rules tightening, and inflation nudging essentials like LPG cylinders higher, the burden of debt feels heavier than ever. […]

Loan Trap: Easy Loans Can Ruin Your Life! Learn 5 Simple Ways to Avoid a Debt Trap

Imagine this: You take a quick loan to cover an emergency, only to find yourself drowning in EMIs a year later. This is the reality for thousands of middle-class Indians today. Do you know that easy access to loans, credit cards, and BNPL (Buy Now Pay Later) schemes is pushing thousands of middle-class Indians into […]

Struggling with Debt? Learn How to Take Control and Secure Your Financial Future

Debt in your life can be a mixed blessing. It helps to fund your future personal and business growth plans to impulse purchases and facilitates an instant infusion of cash. Debt within limits can improve your financial stability but too much of it can have a contrary effect when it overwhelms your financial stability. Whenever […]

How to Stop Falling into the Debt Trap Each Month

Do you find it challenging to make your salary last through the month? You’re not alone! Many people in India struggle to break free from this pattern, constantly relying on credit cards, easy loan apps, or Buy Now Pay Later (BNPL) schemes to cover their expenses. The reality is, without a solid financial strategy, the […]

5 Ways to Protect Yourself from Financial Fraud

Apart from traditional fraud mechanisms, there has been an unprecedented increase in the number of online and cyber frauds in India recently. The digital transformation has spurred on criminal activities done through computers and networks. Cybercrimes have taken away 0.7% of India’s GDP. Cybercrimes range from phishing attacks, identity thefts to online thefts, posing serious […]

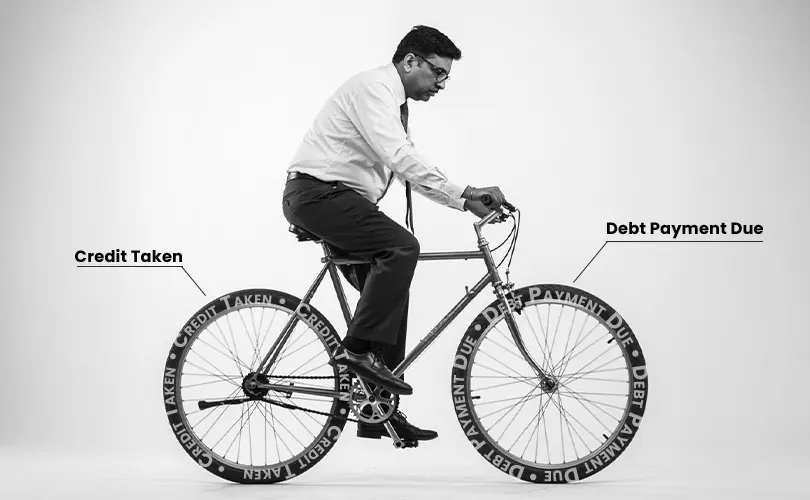

India’s Debt Dilemma: Credit fueled dreams crushed by debt crisis.

Did You Know: “India’s personal & MSME debt is a growing concern: ₹30 trillion in personal debt and a staggering ₹70 trillion in MSME debt”. India’s economic engine thrives on a delicate balance. On one hand, access to credit and loans (debt) fuels the ambitions of millions. It empowers individuals to improve their quality of life, […]

In A debt Trap? Know Your Rights As A Borrower

Running a small business can be tough, especially when debt starts piling up and it feels like there’s no way out. It’s important to know that many business owners face this challenge and that there are rights and options available to help manage and overcome debt. Understanding your rights and knowing what steps you can […]

Debt Consolidation- Is It An End All Solution to All Your Debt Woes?

Debt Consolidation is often touted a one-stop solution to all your debt woes. Education loan, personal loan, and student loans, you may be labouring under the burden of all these different loans. It is sometimes very difficult to track and make the different loan repayments and principal payments along with juggling your work responsibilities. Debt […]