What is Debt Consolidation & How Does It Work in India?

Your browser does not support the audio element. As a person, you have many responsibilities when it comes to your finances. You are either responsible for extra expenditure like shopping, movies, food, etc, or you’re in the junction of paying your business expenses. No matter what expenses you incur with a credit card or a […]

What is a Debt Management Plan?

A debt management plan, or DMP in short, is an easy payment plan that helps you to maintain your debts. Those who are having difficulties in repaying their debts or unable to negotiate for a lower monthly payment can set up a debt management plan. The debt management plan is an effective yet smooth procedure, […]

The reason why you should avoid loan default

CLICK HERE TO CONNECT WITH US ON WHATSAPP AND KNOW MORE ABOUT OUR SERVICES. Are you under the shadow of taking loans from banks and NBFCs? If yes, then this informative article will help you from avoiding the problems of loan default and repaying your loan on time. Let me give you a vision of […]

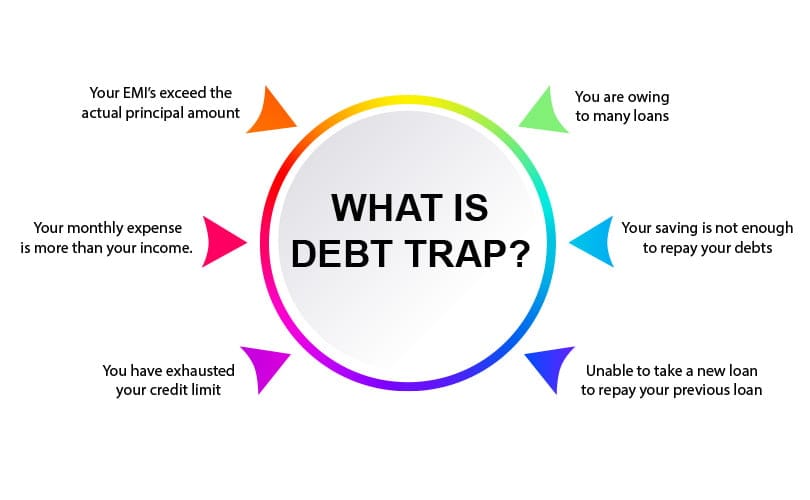

How to avoid falling into the debt trap

If you own a credit card, you really need to know how to handle it in a smart way. Using a credit card does not mean that you can go over your credit limit. One should understand the difference between swiping a credit card and using it excessively. One should take out multiple lines of […]

Ways to build credit score after a loan settlement

We frequently choose to utilise a credit card when we have an urgent financial requirement, mainly due to us not having the funds at that moment. We may also be using our credit cards to meet our monthly bills, which is good as long as we are able to pay the outstanding in full before […]

How to repay your debts

How to repay your debts: Guide to debt management services in India You might be wondering how a debt management service can make you debt-free or repay your debts with a sufficient amount of income. In order to repay your debts, you just need an affordable debt management plan rather than keeping hope that you […]

Buy Now Pay Later

With the outbreak of the COVID-19 pandemic, installment payments have exploded in popularity along with a normal surge in online shopping. Among this installment, we are commonly hearing the term buy now pay later which is becoming increasingly popular with consumers. At first, this may sound convenient and easy, but it ultimately spells financial trouble […]

Struggling to repay you Credit Card Debts? Seek help from Specialist Credit Counsellors and Debt Management Advisors

Struggling to repay you Credit Card Debts? Seek help from Specialist Credit Counsellors and Debt Management Advisors Have you wondered why credit card money is easy to spend and difficult to repay? Having a credit card has become an important asset for people to meet their monthly expenses. Credit cards not only offers you the […]

What Can Debt Counselling Offer Me?

CLICK HERE TO CONNECT WITH US ON WHATSAPP AND KNOW MORE ABOUT OUR SERVICES. What debt counselling can offer me? People suffering from major debt crises can gain financial literacy and freedom through debt counselling. Let us understand what debt counselling is and what it offers. What is Debt Counselling? Debt counselling is a financial […]

RBI Observed Financial Literacy Week in February

CLICK HERE TO CONNECT WITH US ON WHATSAPP AND KNOW MORE ABOUT OUR SERVICES. The Reserve Bank of India (RBI) has declared February 14 to 18 as financial literacy week in order to promote financial education among the public. The program is aimed at educating the general public on the importance of financial literacy and […]