Debt Free Living: Choosing the Best Method to Pay Off Debt

You may be a borrower with exposure to many types of debts resulting in multiple outstanding balances. Remember that all debt carries interest charges on them. Paying off multiple debts requires hard work that can be overwhelming. It depends on the balance between your debt and income. Paying off debt requires careful budgeting and planning […]

How Women Are Using Debt Management to Thrive in 2025’s Economy

Why is 2025 the Year Women Will Redefine Debt? In 2025, women aren’t just managing debt—they’re rewriting the rules. Consider this: 63% of women in India now use digital finance tools (World Bank, 2024), and women-led startups are securing 40% more debt financing than a decade ago (Forbes, 2024). Yet, inflation, shifting job markets, and […]

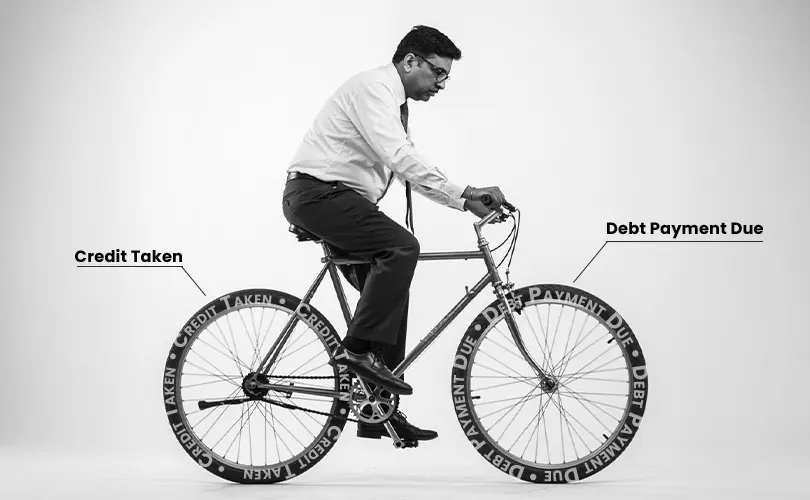

Is Your Salary Draining Away in EMIs? 4 Effective Ways to Break the Debt Cycle

Are Your EMIs Controlling Your Finances? Do you find yourself waiting eagerly for payday, only to see most of your salary vanish into EMIs within days? If so, you’re not alone in this struggle many face the same challenge and it starts with taking back control of your finances. Millions of salaried individuals in India […]

Struggling with Debt? Learn How to Take Control and Secure Your Financial Future

Debt in your life can be a mixed blessing. It helps to fund your future personal and business growth plans to impulse purchases and facilitates an instant infusion of cash. Debt within limits can improve your financial stability but too much of it can have a contrary effect when it overwhelms your financial stability. Whenever […]

How to Stop Falling into the Debt Trap Each Month

Do you find it challenging to make your salary last through the month? You’re not alone! Many people in India struggle to break free from this pattern, constantly relying on credit cards, easy loan apps, or Buy Now Pay Later (BNPL) schemes to cover their expenses. The reality is, without a solid financial strategy, the […]

5 Ways to Protect Yourself from Financial Fraud

Apart from traditional fraud mechanisms, there has been an unprecedented increase in the number of online and cyber frauds in India recently. The digital transformation has spurred on criminal activities done through computers and networks. Cybercrimes have taken away 0.7% of India’s GDP. Cybercrimes range from phishing attacks, identity thefts to online thefts, posing serious […]

Navigating Debt and Financial Challenges in the New Year : The Shrinking Middle Class

A report by Economic times suggested that the socio economic gap is widening with the lower income middle class increasingly shrinking and the super-rich class increasing their wealth. The rich grew their wealth by 86% whereas the middle class shrunk by 25%. This has a boomerang effect on consumption and the rise in inflation has […]

Building a Safety Net: Why an Emergency Fund is Essential for the New Year?

Building a Safety Net: Why an Emergency Fund is Essential for the New Year? Home Blog Building a Safety Net: Why an Emergency Fund is Essential for the New Year? Did you know that as of mid 2024, Indian household savings have hit their lowest point in 50 years, according to the Reserve Bank of […]

Facing Job Loss? Strategies for Managing Expenses in the New Year

Did you know that 75% of Indians don’t have sufficient funds to handle emergencies, according to a Business Standard Report? Job loss can be an overwhelming experience, but with the right strategies, you can weather the storm and manage your finances effectively. As the New Year has dawned, many of us reflect on the past […]

High Interest Rates: How to Tackle Credit Card Debt in 2025

Credit card debt is becoming an attractive proposition for most millennials as they come with attractive offers like rewards systems and life-long free membership offers. Each credit card company is competing with the others to offer more and more attractive rewards. The year-end sales by e-commerce platforms, the one month credit that comes with paying […]