If you own a credit card, you really need to know how to handle it in a smart way. Using a credit card does not mean that you can go over your credit limit. One should understand the difference between swiping a credit card and using it excessively.

One should take out multiple lines of credit, such as loans, credit cards, etc., only if they are capable of repaying them on time. The risk of falling into a debt trap increases if you can’t repay your borrowed money and have no solution to repay it.

People who are caught in a debt trap are unable to repay the borrowed money for a long time. As a result, the debt increases due to interest charges and late fees. It is a process of rigorous burden which is never ending.

People find themselves in a critical situation of a debt trap that can be swamping, stressful, and even dramatic. With time, you can get stuck in a situation where the debt spirals out of control because it exceeds your repayment capacity.

When you take out a loan from a bank or any other lender, you must consider two elements: The principal loan amount and the interest rate charged on the principal loan.

You can only make progress towards your financial stability by repaying your debt amount and reducing the amount. When you repay your monthly payment, you are making two payments towards both the principal as well as interest. A loan is designed to be repaid in a series of fixed monthly payments over the loan term.

In the event that you’re unable to pay your bills, you are likely to end up in a debt trap. Your principal amount doesn’t get reduced, and the interest keeps on piling, making it almost impossible for you to pay off your loan.

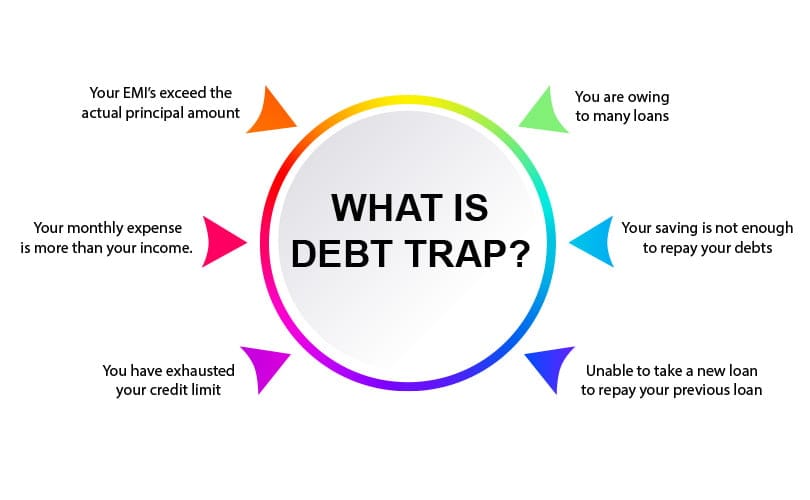

For a person to understand the reason why they fall into a debt-trap, they need to know the following things:

– Your EMI’s exceed the actual principal amount

– Your monthly expense is more than your income.

– You have exhausted your credit limit

– You are owing to many loans

– Your saving is not enough to repay your debts

– Unable to take a new loan to repay your previous loan

In a situation where you are not able to get any solution for additional credit or loan you are risking yourself in debt trap.

Taking out loans to repay the previous loan but then not being able to repay it back is a debt trap.

Unfortunately, the majority of people become the victim of the same situation if they are not able to repay their loans

Following is the solution to avoid falling into the debt trap:

A detailed and great attention to the problem will provide you with the answer to your existing debt situation

Here’s what you can do:

After a thorough analysis of your debt situation, you may now be able to assist your essential, semi-essential and non-essential expenses.

If your income is not sufficient to repay your debts, considering a debt management plan from a debt advisor is a better option. With their customised and negotiable plan with recovery agents, banks, and NBFC’s you can slowly but steadily come out of debt and from the debt trap.

You should keep your dues paid on time in order to avoid falling into the debt trap. Having your credit cards, loans, and other EMIs paid off makes it easier to reach your financial goals. Carrying a nature or the habit of avoiding your repayment can find yourself in a debt trap.

Our lifestyle plays an important role in determining our financial stability. Cutting unnecessary expenses and changing your daily habits are good ways to avoid debt traps. It is suggested to make a monthly budget to manage your income in a manner where you are able to reduce your expenditure and save more money.

If you are struggling with repayment of debts, the last thing that will hit the course is to stop paying them. This can lead to recovery agent harassment and severely affect your credit score. If you feel you are not in a position to repay your EMI’s, a debt solution is always available. A debt solution program with us will give you an affordable Debt Management plan so you can repay your debts and live stress-free. Contact SingleDebt on +91 961 910 3594 or fill out the form either on the home page or contact page