In today’s world, millennials are driven by aspirational spending. The GDP growth, the post-pandemic economic boom has all spearheaded a massive retail debt escalation in the economy. Credit card debt at the end of 2023 was around Rs 2.1 lakh crores in the Indian economy. By 2027, the number of BNPL users in India is expected to reach 900 million according to Juniper Research. The plentiful availability of credit cards with attractive offers and the BNPL offers, which encourage retail personal loans, can all result in a debt spiral. With convenient digital channels to borrow from, online KYC, instant disbursal, and easy eligibility criteria, borrowing has indeed become very easy.

Loans can enable you to borrow very easily, but juggling several debts can be difficult indeed. The best way to be financially prudent is to streamline your borrowing and spending patterns. It is best to minimise your spending and ensure that you make timely payments on all your outstanding debts. Ensure that you track all your credit card and personal loan repayments and create a timely schedule to make the repayments.

You can solicit the services of SingleDebt, a reputed financial advisory and debt management firm to assist you with both financial and legal advice and help you deal with your debt burden.

The introduction could be more engaging by starting with a relatable scenario or statistic about debt.

Add a statistics to capture attention.

Here are six crucial debt management tips to learn in 2024 to secure your financial future.

Understanding the full scope of your debt is the first step in managing it effectively. Keep a detailed list of all your debts, including credit card balances, student loans, mortgages, and any other outstanding obligations. This list should include the total amount owed, interest rates, minimum monthly payments, and due dates. Regularly review and update this information to stay on top of your financial situation. Use apps or financial software to help track your debts more efficiently.

Paying bills on time is essential to avoid late fees and protect your credit score. Set reminders or automatic payments to ensure you never miss a due date. Consistent, timely payments not only save you money but also build trust with creditors, enhancing your chances of favourable loan terms in the future.

A realistic budget is essential for an effective and crucial debt management plan. Start by tracking your income and expenses to understand your spending habits. Categorise your expenses into essential (e.g., housing, utilities, groceries) and non-essential (e.g., entertainment, dining out). Allocate a portion of your income to debt repayment, and adjust your spending to ensure you live within your means. Regularly review and adjust your budget as necessary to stay on track.

Whenever possible, pay more than the minimum payment on your debts. Paying only the minimum prolongs the repayment period and increases the total interest paid over time. Aim to pay the full outstanding amount each month to reduce the principal balance more quickly. This strategy helps you save on interest and can significantly shorten the time it takes to become debt-free.

Explore different, crucial debt management options to find the one that best suits your situation. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments. Debt settlement programmes negotiate with creditors to reduce the total amount owed. Credit counselling services offer professional advice and help you develop a personalised debt repayment plan. Evaluate the pros and cons of each option to determine the most effective strategy for your financial needs.

If you’re struggling to manage your debt, don’t hesitate to seek professional help. Financial advisors, credit counselors, and debt management agencies can provide valuable guidance and support. They can help you understand your options, negotiate with creditors, and develop a realistic plan to get out of debt. Remember, seeking help is a proactive step towards financial stability and should not be viewed as a failure.

By incorporating these tips into your financial routine, you can take control of your debt and work towards a more secure financial future.

Managing retail debt effectively involves a combination of strategic planning, budgeting, and potentially seeking professional assistance. Here are some reliable solutions:

Personal Loans: Consider consolidating multiple debts into a single loan with a lower interest rate.

Balance Transfer Credit Cards: Transfer high-interest credit card debt to a card with a lower interest rate, often with an introductory 0% APR period.

Seek assistance from a reputable financial advisory agency . They can provide personalised advice and may help negotiate lower interest rates or better terms with creditors. They will guide you towards better financial management.

A debt solutions company can help create a crucial Debt management plan where you make a single monthly payment to the agency, which then pays your creditors. They also often negotiate a lower interest rate. This can simplify payments and potentially reduce interest rates. Debt consolidation is a reliable solution where all your different EMIs are rolled into one single affordable EMI, which means you make repayments on only your disposable income. This reduces the problems related to making the debt repayments.

Negotiate with creditors to settle for a lump sum payment that is less than the full amount owed. This can negatively impact your credit score but may be a viable option for significant debt

Reduce unnecessary expenses and consider additional income sources, such as part-time work or freelance opportunities, to accelerate debt repayment.

Consult a financial advisor for personalised guidance tailored to your specific situation and long-term financial goals.

In certain circumstances, you might be eligible for a debt forgiveness programme.

Each of these solutions has its own advantages and considerations, and the best approach depends on your individual financial situation and goals.

Managing debt effectively is key to financial stability. First, create a budget to track income and expenses, ensuring you live within your means. Second, you must prioritise paying off high-interest debt to save money in the long run. Third, consider consolidating debts to simplify payments and potentially lower interest rates. Fourth, build an emergency fund to avoid relying on credit for unexpected expenses. Fifth, communicate with creditors to negotiate better terms if you’re struggling. Lastly, seek professional advice if needed to develop a personalised and crucial debt management plan. When you follow these tips, you can take control of your financial future.

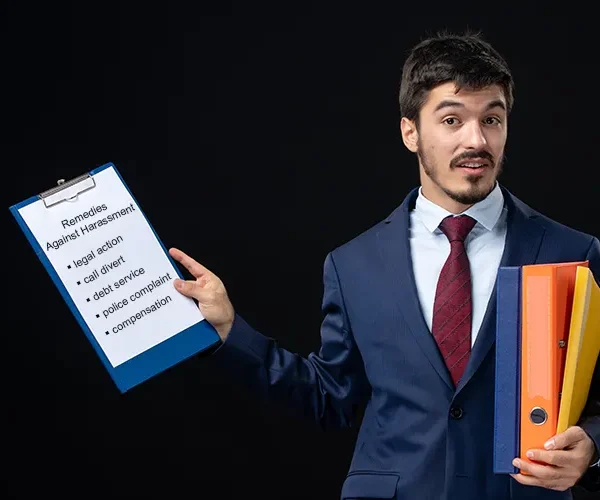

When you are going through a financial crisis, SingleDebt can be your first port of call to solve all your debt management problems. We are well known in the financial market for our 40 years of global experience and state-of-the-art debt management and financial advisory solutions. We also help you to deal with legal problems and the harassment posed by loan recovery agents.

The first tip is to create a realistic budget. This helps you track income and expenses, ensuring you live within your means and can allocate funds to pay off debts effectively.

Prioritizing high-interest debt is crucial because it helps reduce the amount of interest you pay over time, saving money and allowing you to pay off debts more quickly.

A personalized debt management plan can simplify payments by combining multiple EMIs into a single affordable monthly payment, often at a lower interest rate, making it easier to manage and potentially reducing overall debt. Depending on the company, it can also come with the benefit of anti-harassment and legal support for a peaceful day-to-day life, like offered by SingleDebt.

An emergency fund provides a financial cushion for unexpected expenses, preventing you from accumulating more debt when emergencies arise.

Seeking professional advice can provide personalized strategies and support, helping you navigate complex financial situations and create a viable plan to pay off your debts.

© COPYRIGHT 2024 ALL RIGHTS RESERVED | CITY CREDIT MANAGEMENT LLP T/A SINGLEDEBT | CIN: AAN-6607 | GST: 27AAOFC0728P1ZY