Feeling overwhelmed, he sought assistance from SingleDebt in October 2020, enrolling both himself and his wife into our Debt Management Plan (DMP). Their primary concern was to put an end to the constant harassment from creditors, allowing them to regain control over their financial lives.

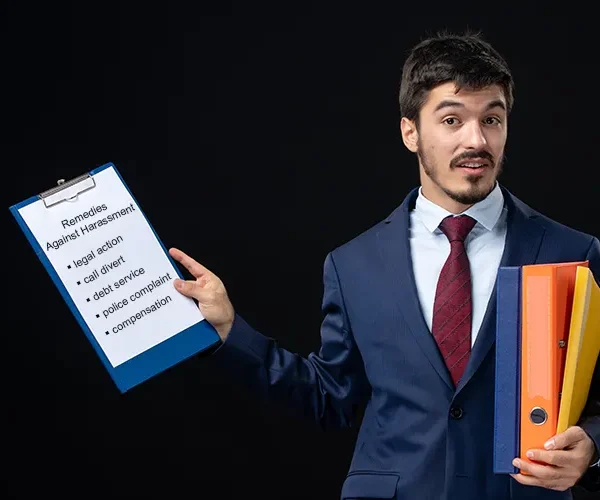

Upon joining, our team immediately began addressing the creditor issues. It took several months of consistent communication from our paralegal and legal teams, but we gradually managed to reduce the frequency of aggressive calls and home visits. Our lawyers worked diligently to communicate with the banks and recovery agents on behalf of our client, ensuring that all interactions were handled professionally and within legal boundaries. Eventually, we were able to stop most of the harassment, giving their family much-needed relief.

With the immediate pressure of creditor harassment lifted, our client was able to refocus his energy on finding freelance work. This newfound clarity allowed him to improve his financial situation significantly. Over the course of four years, he entrusted us with managing his 21 loan accounts, amounting to ₹17 lakhs. Thanks to his unwavering trust in the process and his adherence to our advice, we have successfully closed 6 of these accounts, significantly reducing his overall debt.

A key factor in his success has been the consistency and open communication with our team. Despite occasional financial setbacks, he always stayed in contact with us, allowing us to make necessary adjustments to his DMP to accommodate his changing circumstances. For 48 months, he has diligently made his regular payments without fail, which has been crucial in managing his debt effectively.

Today, our client experiences minimal harassment from creditors. Calls and home visits are now rare, allowing him and his wife to live with much less stress. His satisfaction with our services is evident in the fact that he has referred many new clients to SingleDebt, a testament to his positive experience and the trust he has in our team.

His journey is a clear example of how, with the right support and a committed approach, even seemingly insurmountable financial difficulties can be overcome. Through SingleDebt’s ongoing guidance, he continues to make steady progress toward becoming debt-free.