Debt harassment by loan recovery agents in India has become a growing concern in recent years. You often face aggressive and unethical tactics from 3rd party recovery agents, including persistent phone calls, threats, and even physical intimidation. This behavior not only violates personal privacy but also causes significant emotional and psychological distress to individuals struggling with debt. The situation is worsened by a lack of stringent regulations and enforcement mechanisms to protect you from such loan harassment. Addressing this issue requires a comprehensive approach, including stronger legal frameworks, better oversight of recovery practices, and increased education and awareness about debtor rights.

SingleDebt is a reputed financial advisory and debt management company with over 40 years of global experience in protecting your legal and financial rights against undue loan harassment by loan recovery agents.

In India, recovery agent led loan harassment can take various forms, some of which include:

Verbal Abuse: Recovery agents may use aggressive language, threats, or verbal insults to intimidate the debtor.

Physical Intimidation: In extreme cases, recovery agents may resort to physical threats or damage to property against individuals or their family members.

Constant Calling and Messaging: Loan harassment often includes incessant phone calls, text messages, or emails demanding repayment, sometimes at odd hours or using multiple phone numbers.

False Threats: Agents may falsely threaten legal action, property seizure, or damage to the debtor’s reputation if payment is not made immediately.

Privacy Violations: Agents might disclose the debtor’s financial situation to others, causing embarrassment or reputational harm.

Misrepresentation: This includes misleading you about the consequences of non-payment or misrepresenting the agent’s authority or affiliation.

Unfair Practices: This can involve pressuring you to sell assets or borrow money to repay debts, or insisting on repayment from relatives or friends.

These practices are illegal under the Reserve Bank of India’s Fair Practices Code for lenders and recovery agents. Victims can report such incidents to the lender, consumer forums, or even the police for appropriate action.

The Reserve Bank of India (RBI) has laid down several regulations and guidelines for the regulation and supervision of loan recovery agents to ensure fair practices and protect your rights as a borrower. Here are some key regulations:

Code of Conduct: RBI mandates that recovery agents appointed by banks and financial institutions should follow a code of conduct. This includes guidelines on polite behavior, respecting privacy, and ensuring that there is no loan harassment of you or your family.

Identification: Recovery agents must carry proper identification cards issued by the bank or financial institution they represent. They should display these cards prominently during their interactions.

Training: Banks and financial institutions are required to provide training to recovery agents to ensure they understand and comply with the RBI guidelines and legal framework. This training should emphasize ethical practices and customer rights.

Fair Practices: Agents must adhere to fair practices in debt collection, which includes not using intimidation, loan harassment, or coercion to recover dues. They should also avoid visiting your residence or place of work except between 7 am and 7 pm.

Privacy and Confidentiality: Agents must maintain the confidentiality of your information and only disclose it to authorized persons or agencies.

Monitoring and Reporting: Banks and financial institutions are responsible for monitoring the activities of recovery agents and ensuring compliance with RBI guidelines. They must also report any violations or complaints regarding recovery practices to the RBI.

These regulations aim to ensure that loan recovery agents operate within ethical boundaries and treat you with respect while carrying out their duties of debt recovery. Violations of these guidelines can lead to penalties for the financial institution involved.

The Reserve Bank of India (RBI) has issued guidelines and regulations to govern the practices of loan recovery agents (LRAs) to ensure fair treatment of you as a borrower. Here are some practices specifically prohibited by the RBI:

Harassment: Recovery agents are prohibited from using intimidation, coercion, or loan harassment of any kind towards you or your family. This includes threats of violence or use of force.

Privacy Violation: Agents cannot disclose the details of your debt to any unauthorized third party. This protects your confidentiality and prevents undue embarrassment.

Unfair Practices: Agents cannot resort to unfair means for recovery, such as seizing or forcibly taking possession of your property without following legal procedures.

Misrepresentation: They cannot mislead you about the consequences of non-payment or misrepresent the amount owed.

Contact Timing: Recovery agents cannot contact you at odd hours or during times and places that may cause inconvenience or embarrassment.

Respect for You: Agents must treat you with dignity and respect your right to fair treatment.

These guidelines are aimed at ensuring that the recovery process is conducted in a fair and respectful manner, protecting your rights and dignity.

Loan recovery agents, also known as debt collectors or recovery agents, are typically hired by banks, financial institutions, or creditors to recover overdue debts if you have defaulted on their loans. Here are some activities that loan recovery agents are generally permitted to do:

Contacting you: They can contact you via phone calls, emails, or letters to remind you about the overdue payments.

Visiting Your Residence or Workplace: They may visit your residence or workplace to discuss the outstanding debt. However, they must do so within reasonable hours and in a civil manner.

Negotiating Repayment Terms: They can negotiate with you on behalf of the lending institution to settle the debt, arrange for repayment plans, or explore other options to recover the amount due.

Legal Action: In some cases, they can initiate legal proceedings against you as per the guidelines and laws governing debt recovery in the jurisdiction.

Repossessing Collateral: If the loan is secured by collateral (like a vehicle or property), and if you default on payments, recovery agents may take steps to repossess the collateral as per legal provisions.

However, it’s important to note that there are strict regulations and guidelines governing the actions of loan recovery agents. They are not permitted to harass, intimidate, or use force against you. They must adhere to legal and ethical practices while attempting to recover debts.

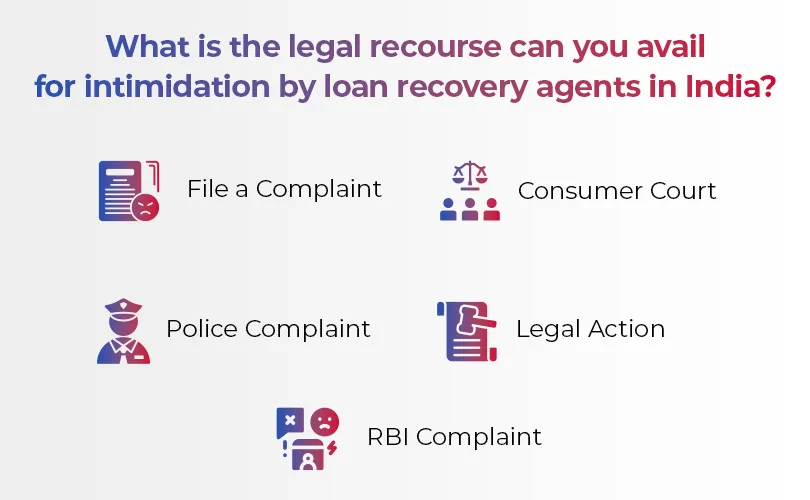

If you’re facing intimidation or loan harassment by loan recovery agents, there are several legal resources you can consider:

File a Complaint: You can file a complaint with the bank or financial institution from which you took the loan. They are obligated to investigate and address your complaint.

Police Complaint: If the intimidation involves threats, physical harm, or any illegal actions, you can file a complaint with the police. Provide any evidence you have, such as recordings or messages.

Consumer Court: You can file a complaint in the consumer court if you believe that the recovery agents are violating your rights under the Consumer Protection Act, 2019.

Legal Action: You can seek legal advice and take civil action against the recovery agents or the financial institution for loan harassment, intimidation, or any illegal actions. You can bring a legal injunction against them if justified.

RBI Complaint: You can also file a complaint with the Reserve Bank of India (RBI) if the recovery agents are not following the guidelines set by the RBI for loan recovery.

It’s important to document all interactions and gather evidence of any loan harassment or intimidation. Seeking legal advice from a lawyer specializing in consumer rights or civil law can also provide you with more tailored guidance based on your specific situation.

In India, if you face loan harassment from recovery agents, you can take several steps to protect yourself. First, stay calm and avoid arguments. Document all communication and incidents, including phone calls and visits. You have the right to ask for identification and contact the lender directly to resolve issues. If harassed, you can file a complaint with the lender’s grievance redressal officer, and if necessary, approach consumer forums or the police for assistance. It’s important to know your rights and seek help if the loan harassment persists.

You can seek the assistance of a well-established financial and legal advisory company like SingleDebt to assist you legally and protect you against such loan harassment by loan recovery officers and also negotiate on your behalf with the lending agency or the bank from whom you have borrowed.

© COPYRIGHT 2024 ALL RIGHTS RESERVED | CITY CREDIT MANAGEMENT LLP T/A SINGLEDEBT | CIN: AAN-6607 | GST: 27AAOFC0728P1ZY